At Elstree, we construct portfolios which seek to benefit from market opportunities and inefficiencies through a combination of active security and/or sector selection, and active secondary market trading.

We believe the hybrid market offers opportunities for active investors. It is dominated by retail investors who have a limited understanding of bank and insurer capital issues, and who under and over react to issuer specific risks and equity market movements.

Our investment thesis aims to deliver above sector returns that enhance the medium income levels and capital stable nature of the sector.

We control the portfolio risk by using disciplined risk management and a security weighting process to reduce exposure to securities when market or security stress reaches a certain level.

Stock Selection

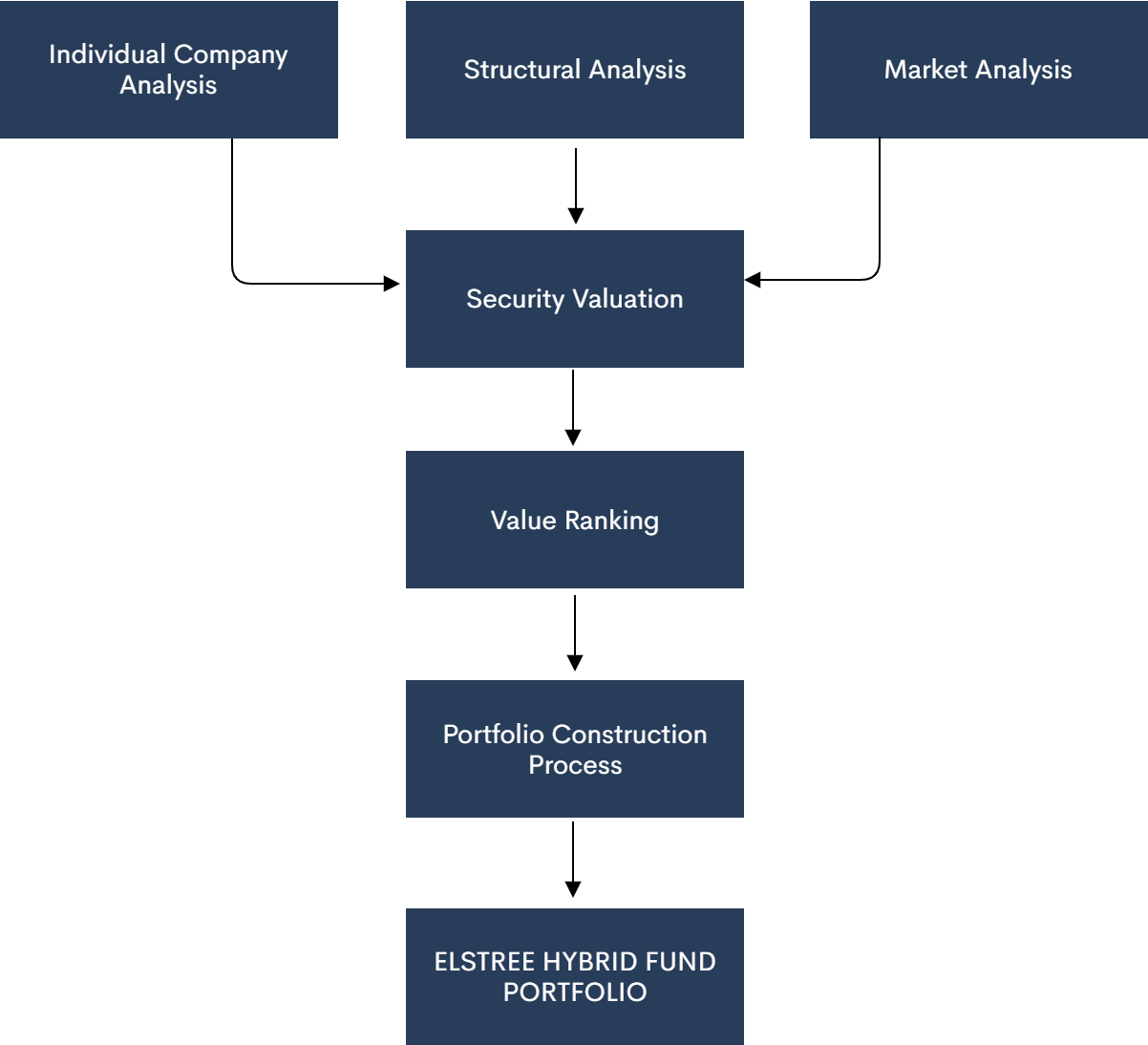

Elstree uses a bottom-up research process to analyse each hybrid security. It undertakes additional analysis that ranks each hybrid on a risk adjusted basis from most preferred to least preferred. It then constructs a diversified portfolio containing its most preferred securities.

Elstree analyses the issuing company, from a fundamental perspective understanding financial ratios and indebtedness, as well as the structure of each security – paying particular attention to the credit risks and understanding any terms in the structure that may change the expected maturity date or maturity value. Undertaking this step involves not only desk research but also company visits.

The end result of the above is to create a yield to maturity for each hybrid that Elstree expects; these are then ranked.

Portfolios are constructed based on the research process which identifies a range of hybrids that are trading below what Elstree believes to be their fair value.

The weighting of each security in the portfolio is dependent on its credit quality and term, its relative value and its liquidity.

Security weightings are monitored daily to ensure they remain within predetermined parameters including mandate/trust parameters. We note that the Manager uses Excel to perform this function (which given the size of the fund and the portfolio is cost effective).

The Fund’s security selection process is detailed in the chart below.

Risk Management

Maximum weighting to individual securities depends on a) a security’s level of relative to the value arrived at by the Manager, b) the security’s liquidity and c) credit quality. While a security’s level of cheapness is subjective, its weighting in the portfolio is determined and limited by quantitative measures such as credit rating and liquidity (turnover). Elstree maintains a daily review of factors of each security in its portfolio to ensure that it continually remains within expected ranges.

Specific rules include:

- Each individual security holding will not exceed 10% of the Fund size. Average investment size is between 3-5% of the Fund.

- The Fund will not hold securities with material exposure to the equity value. This is defined as when the underlying equity price exceeds the strike price of any option embedded in the security. The security shall be sold within three months of this occurrence